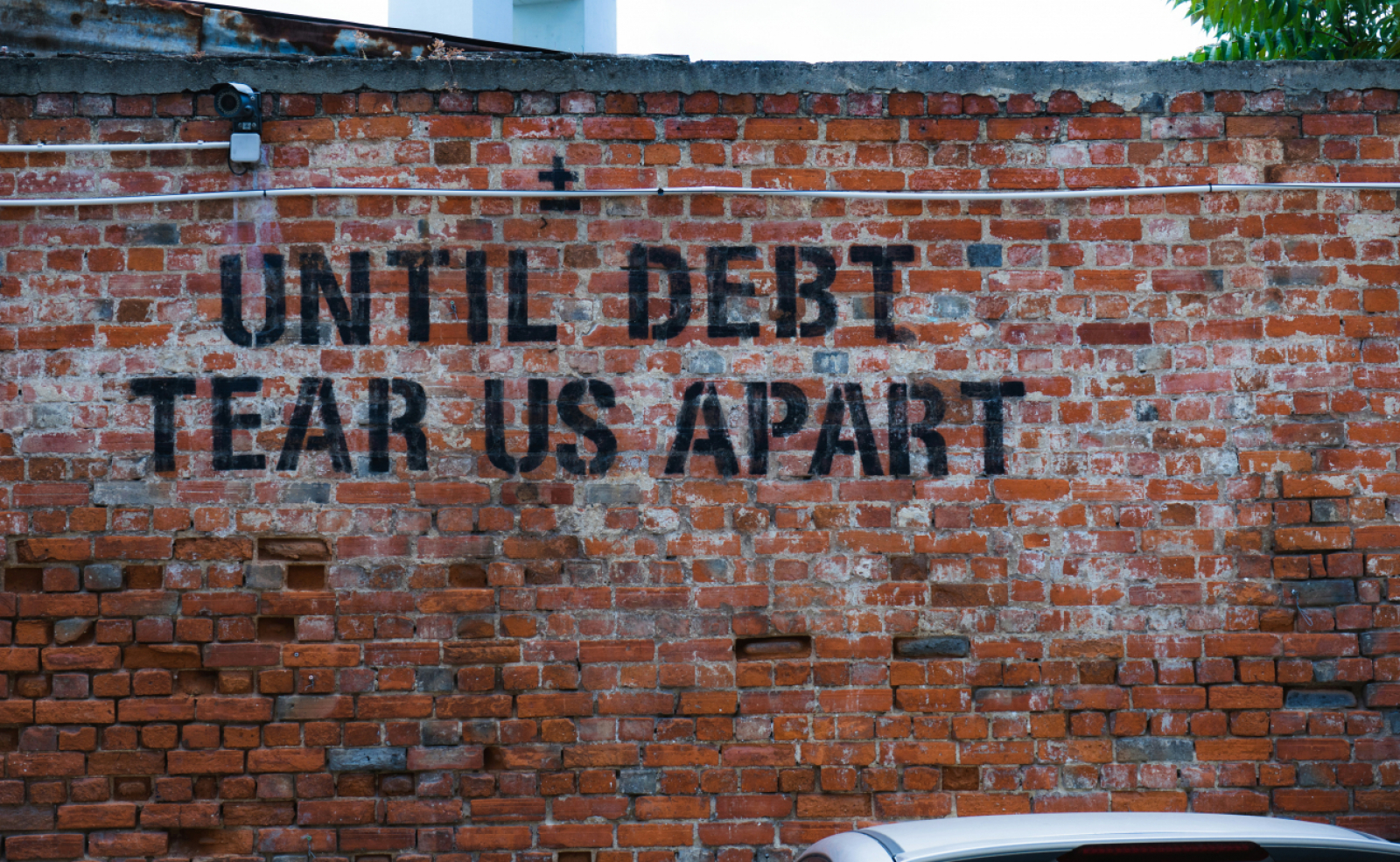

Debt Déjà Vu

The international debt burden has reached unprecedented levels in recent years. Two dozen African countries are in or on the verge of debt distress. As a result, countries are dedicating more and more of their budgets to servicing their debt - holding them back from reaching new heights. Across the globe, recent analysis suggests debt service expenses are 3.7 times health spending and 2.5 times education spending. Ghana, for instance, spends 70% of government revenues on debt repayment and cut its budget allocation for health in nearly half. The resulting cuts in public spending exacts a particularly high toll on women and other vulnerable groups, implying additional unpaid care tasks, higher rates of layoffs and cuts to services. Overall, 3.3 billion people now live in countries where their government spends more on debt service than health or education.

With the emergence of new types of creditors, the lending landscape has become more atomized and less concessional. Over the last decade, the portion of external public debt owed to private creditors increased across all regions, accounting for 62% of developing countries’ total external public debt in 2021. China has become the world’s largest bilateral creditor; of the $35 billion owed in debt service payments, 37% ($13.1bn) is due to China.

The current context of debt crisis deja vu is due, at least in part, to inequities in the international financial architecture. At the same time, critical democracy deficits play an important role in enabling unsustainable borrowing. Though debt transparency has several prominent benefits- including reduced interest rates for borrowers, decreased risk for corruption, and increased efficiency for public finances– in practice, loans are often given without parliamentary and public scrutiny, and in the worst cases without the existence of the loan being disclosed at all. Forty percent of low-income developing countries have neglected to publish any sovereign debt data during a two-year period. While international actors have invested significant resources in improving debt management systems and building the capacity of debt managers, efforts have focused on the executive arm of government and overlooked the broader accountability system, particularly parliaments and civil society.

NDI’s Approach

To counter the negative development and democratic impacts of unsustainable public debt, NDI has launched a multi-faceted program to enhance transparency and accountability.

Parliamentary policy making and oversight: NDI works directly with parliaments, helping to boost capacity through civil society dialogues, expert assessments, technical support and experience exchange, including through networks such as House Democracy Partnership. NDI also contributes knowledge products such as technical briefs for parliament.

Civil society advocacy and monitoring: NDI also supports inclusive civil society coalitions around the world to advocate for legal framework reform, monitor loan agreements and implementation, and put pressure on borrowers and lenders for public disclosure. NDI also develops civil society oriented tools, such as the forthcoming Debt Transparency Checklist with Transparency International.

Open Government solutions: In collaboration with the Open Government Partnership (OGP), NDI is raising global awareness of the current debt crisis and helping countries make commitments to debt transparency in their OGP national action plans.

Global dialogues: Recognizing that doing debt democratically requires commitment from both borrowers and lenders, NDI supports global conversations and thought leadership that feature partner voices and actionable solutions.

NDI has produced the following products related to debt:

- Debt Disclosed: A Civil Society Checklist for Debt Transparency and Accountability

- Open Gov Guide: Public Debt

-

Foreign Debt Opacity Briefs

- Parliament's Role in Emergency Fiscal Policy: Lessons Learned for Emergency Planning

Featured Media on NDI's Debt Programming:

-

Tackling Zambia’s Debt Problem: Supporting Debt Management Reforms Through Cso Collaboration

-

Supporting Malawi’s Parliament To Apply A More Critical Eye To Public Debt

-

Catching The Oversight Express: Parliamentary Engagement In Debt Deliberation And Scrutiny

-

The Summit for Democracy’s missing link is debt transparency

-

Tackling Zambia's Debt Problem: Supporting Debt Management Reforms through CSO Collaboration

-

Democratic Reset: Transparency and Accountability Lessons to Break the Debt Crisis Cycle

Photo by Ehud Neuhaus on Unsplash